A donation of appreciated securities in the form of an “in-kind” transfer is a great way to make your gift to Heart-Links go further. By donating stock directly you pay fewer taxes compared to selling stock and donating the proceeds.

| Sell stock & donate proceeds | Donate stock directly | |

|---|---|---|

| Original value of securities | $12,500 | $12,500 |

| Current market value | $25,000 | $25,000 |

| Realized capital gain | $12,500 | $12,500 |

| Tax on capital gain* | $2,875 | $0 |

| Donation tax credit** | $10,000 | $10,000 |

| Net tax benefit | $7,125 | $10,000 |

| Net benefit from donating stock | $2,875 |

**Tax credit is 40% of receipt value

For tax purposes, Heart-Links will issue a charitable receipt for the fair market value of the securities. Fair market value is the closing price of the securities on the day the gift is received by Heart-Links. Download our Charitable Donation of Securities Authorization Form and take it to your broker or write to info@heart-links.org for more information.

Our Charity Registration Number is 86596 7517 RR0001

Who will your gift help?

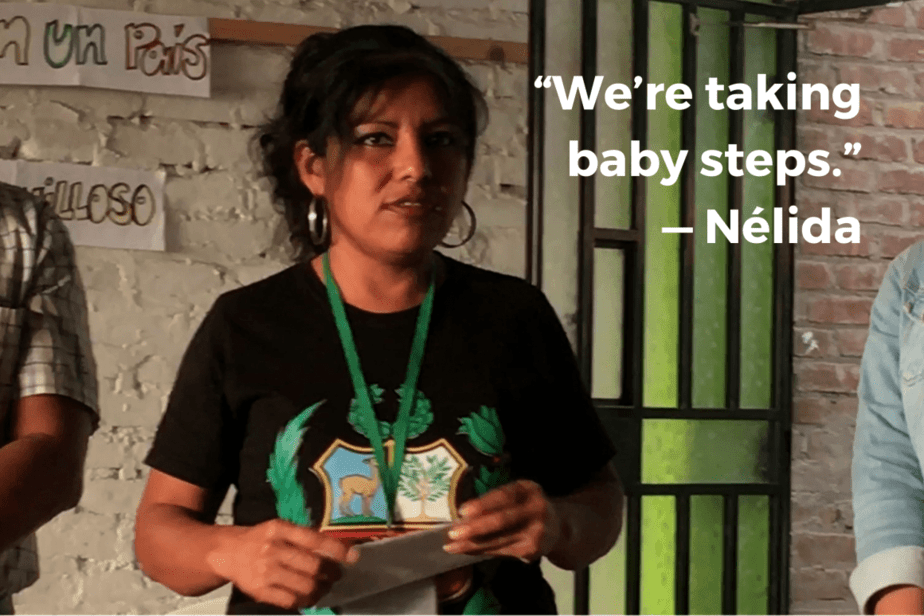

People like Nélida. Nélida lives in a marginal settlement in José Leonardo Ortiz that has no paved roads and is very neglected and forgotten by the authorities. “It’s just a sea of dirt and sand,” she says. Nélida signed up for the Leadership School, run by Heart-Links’ partner Centro Santa Angela, because she wanted to learn how to help her community and to see it prosper.

As a member of the Park Committee in her neighbourhood, she is working to establish a park on an empty lot there. But the municipal government told her committee that there was no money for that kind of thing.

That didn’t stop Nélida. Thanks to the Leadership School, she’s learned about how to fundraise and do fund development and how to generate support. “We’re taking baby steps that will lead to many other things in the future,” she says.